The gender pay gap between men and women working full time is at its widest for those aged 50-plus, according to Rest Less, a digital community for the over 50s.

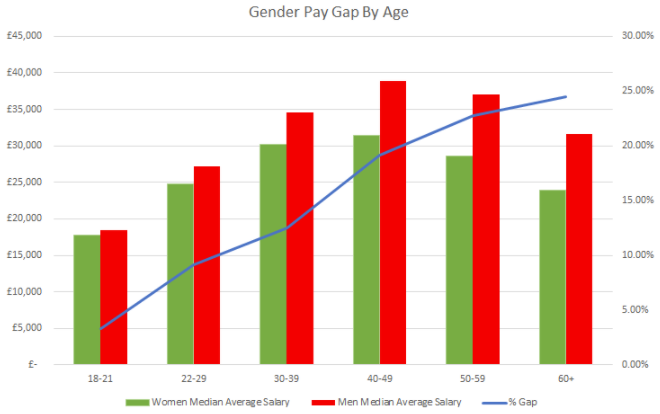

Older women face a significantly greater gender pay gap than their younger counterparts, with women over the age of 50 earning around £8,000 less a year on average than men of the same age. After analysing data from the Office for National Statistics (ONS), Rest Less found a 23% pay gap between full-time working men and women in their 50s, averaging £8,427 a year. The pay gap for women in their 60s was even higher, with women earning 25% less.

AGE BIAS & DOUBLE DISCRIMINATION

“Women in their 50s and 60s face the double discrimination of age bias, combined with the widest gender pay gap of all ages, receiving a salary of £8,000 less per year than their male counterparts in full time employment,” stated Stuart Lewis, CEO & Founder of Rest Less.

According to Rest Less’ analysis, both women and men reach their peak earnings during their 40s when their median annual incomes were £31,403 and £38,829 respectively. That equates to a gap of £7,426 in a woman’s annual salary, which is nearly one fifth (19%) less than men.

In fact, women’s median full time salaries dropped on average by 9% from their peak earnings in their 40s to their 50s. Furthermore, the median earnings for women working full time in their 60s was 24% lower than the median earnings for women in their 40s. By contrast the median salary of men in their 50s, was 5% lower than those of men in their 40s; and for men working full time in their 60s, their median salary was 19% lower than those in their 40s.

HARSH REALITIES FACING OLDER WOMEN

“This new analysis highlights the harsh reality that is facing older women, with the retirement incomes of men and women still far from equal,” pointed out Sheila Flavell, COO, FDM Group. “It is essential to analyse the statistics from within and understand what it is that is preventing more women from progressing into senior roles.”

Once this is established, organisations can “develop a strategy to increase opportunity for women and continually support them on their career paths”, she added. “FDM Group, announced a median gender pay of -2.1% amidst the pandemic, which we are pleased about and will always strive to support women in their careers, with an understanding about the importance of future finance. It is important that companies follow suit and consider gender equality, whilst building a diverse and inclusive workforce.”

SUPPORT FOR RETIREMENT

The drop in median earnings experienced by both men and women after their 40s will “undoubtedly affect people’s retirement savings plans”, noted Flavell. “Moving forward, it is important that organisations help employees as much as possible by providing the support and initiatives that will allow workers to save effectively for retirement regardless of what stage they’re in of their career.

Lewis agrees: “Whilst the state pension age has now been equalised at 66 for both sexes, decades of a gender pay gap and the resulting wide gulf in private pension savings mean that the future retirement incomes of men and women remain far from equal. The fact that earnings peak in our 40s and decline as we head into our 50s and 60s has profound implications for all of us and our retirement savings plans.”

He believes “we can no longer rely on bigger salaries in the years before we retire to fund our pensions, and instead need to consider the most efficient ways to save for retirement from an early age”.