A new report has revealed that global greenwashing has declined for the first time in six years, however the severity of incidents is rising.

In a major shift for the corporate world, new research from RepRisk, which assesses business conduct and ESG risks for organisations worldwide, reveals a significant 12% decrease in global greenwashing risk across all sectors for the year ending in June 2024. This marks the first drop in greenwashing cases in six years, as companies face increasing regulatory pressure and shift towards greenhushing, or under-reporting their sustainability efforts, to avoid public backlash.

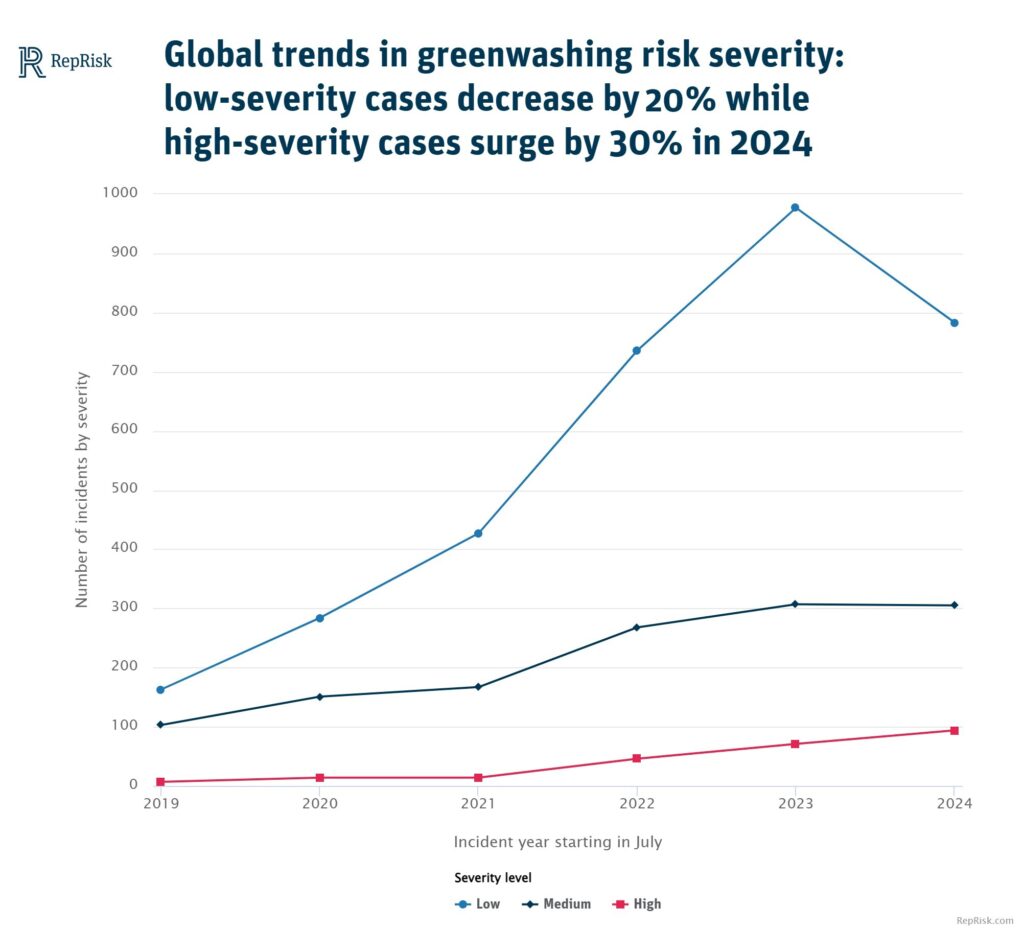

RepRisk’s third annual greenwashing report attributes this decline to a combination of stricter regulations and heightened stakeholder awareness, particularly from consumers, investors, and regulatory bodies. However, while the overall number of greenwashing incidents has dropped, the study also highlights a 30% increase in severe cases, signalling that the issue remains far from resolved.

GROWING STAKEHOLDER SCRUTINY

“Stakeholders are more aware of greenwashing risk than ever before,” said Dr Philipp Aeby, CEO and Co-Founder of RepRisk. “While regulators have successfully pushed forward legislation to deter greenwashing, the risk will keep evolving as new forms emerge, leaving companies open to reputational damage that impacts their bottom line. Greenwashing is often driven by corporate narratives. To uncover it, investors and companies should rely on what external sources reveal about these claims.”

This ongoing shift demonstrates that companies are becoming more mindful of the material risks associated with greenwashing and are taking proactive steps to mitigate their exposure. According to RepRisk, the decline in greenwashing cases is an encouraging sign for governing bodies, which are working to implement pending and active greenwashing legislation.

REGULATIONS DRIVING POSITIVE CHANGE

Despite the overall improvement, RepRisk data shows that 30% of companies linked to greenwashing in 2023 were flagged again in 2024. This suggests that while public perception is influencing companies’ actions, additional regulatory measures and transparent reporting are still necessary to address repeated offenders and curb the rise of severe greenwashing incidents.

The report notes a significant shift in the Banking and Financial Services sector, which saw a 70% increase in climate-related greenwashing from 2022 to 2023. However, a 20% decrease was reported globally across this sector from 2023 to 2024, aligning with broader efforts from the European Banking Authority to tackle greenwashing. Despite this positive trend, over a third (36%) of financial companies linked to greenwashing last year were again implicated in 2024, higher than the 30% cross-sector average.

REGIONAL DIFFERENCES: EUROPE & US

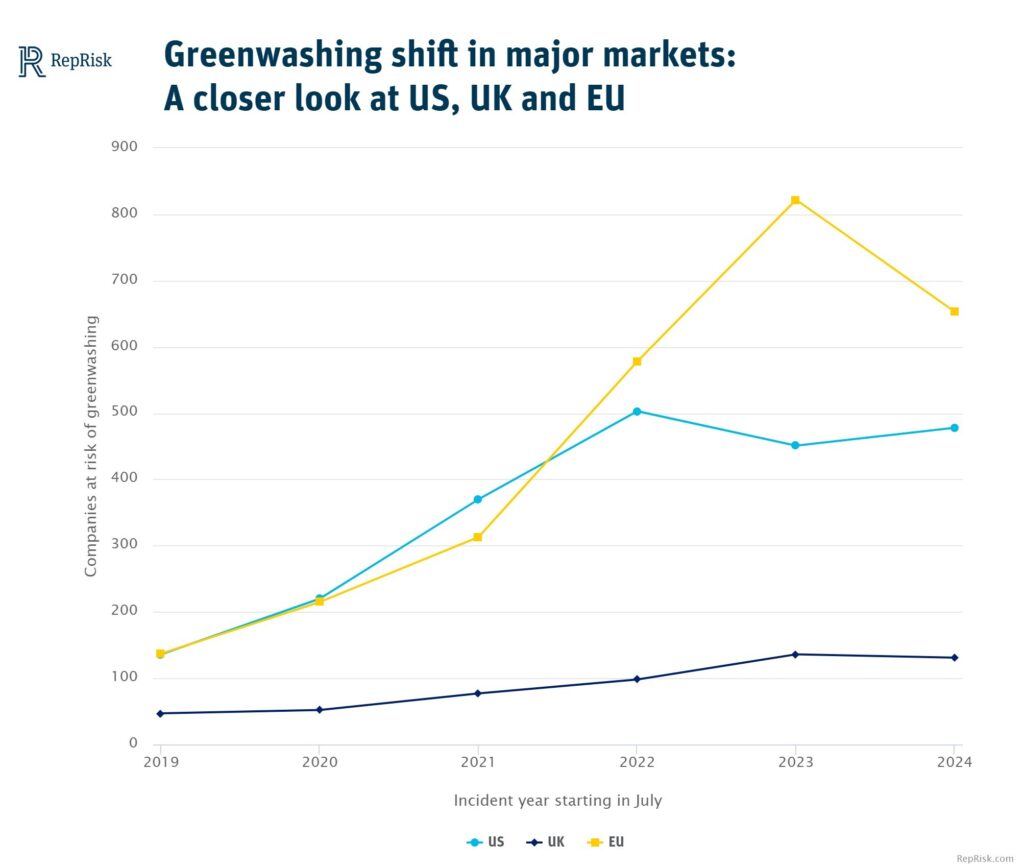

The impact of regulation on greenwashing is clear, with the UK seeing a modest 4% reduction in incidents, while the EU led the way with a 20% decrease. This success in Europe is largely attributed to a slew of new legislation enacted over the past 12 months, including the EU Green Claims Directive, which mandates that companies provide robust evidence to substantiate their environmental claims.

However, the US tells a different story. Greenwashing cases peaked in 2022, with 503 reported incidents – marking a 35% year-over-year increase from 2021. After a 10% decline in 2023, cases rose again by 6% in 2024. This volatility is likely linked to the politicization of ESG in the US, where companies face growing pressure from investors, state attorneys general, and political figures opposed to integrating ESG criteria into business decisions. The rise in greenwashing cases may indicate that companies are becoming more cautious in their green marketing, but the overall trend remains uneven.

COMBATTING GREENWASHING RISKS

While the reduction in overall greenwashing risk is a promising development, the sharp rise in severe incidents shows that more work is needed to address this complex issue. As corporate sustainability claims continue to evolve, stakeholders must remain vigilant in holding companies accountable for their environmental promises, noted the report.

Moving forward, continued regulatory oversight, combined with greater transparency and robust data, will be essential in combating greenwashing and ensuring that companies not only reduce their environmental impact but also communicate their efforts honestly and accurately.