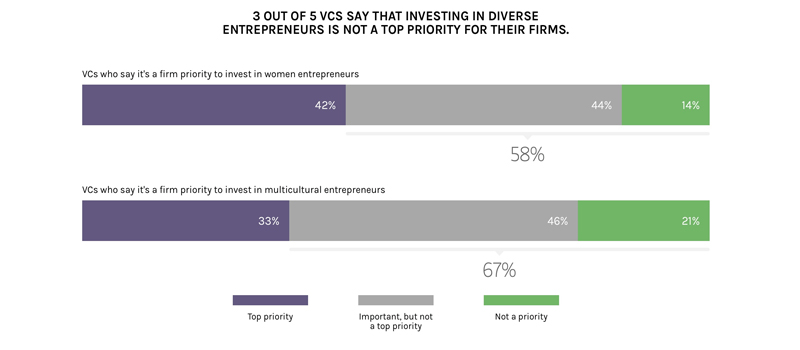

Venture capitalists (VCs) are missing out on a trillion-dollar opportunity by failing to invest in businesses founded by diverse entrepreneurs, according to Morgan Stanley’s latest report Beyond The VC Funding Gap. Despite acknowledging the opportunities these groups present, 3 out of 5 VCs said that investing in female and multicultural entrepreneurs is ‘not a priority’, revealed the global financial services firm.

‘Not the right fit for me’ and ‘market-related issues’ were cited as the main reasons for not investing in diverse entrepreneurs, suggesting that the ‘field of vision of many VCs may be too narrow’. VCs that are able to ‘adjust their lens’ are more like to spot these opportunities, according to Morgan Stanley. The findings in its latest report are based on approximately 200 US-based VCs and diverse entrepreneurs.

OUTDATED ATTITUDES & METHODS

Despite being data-driven, VC firms aren’t acting on the data on diverse entrepreneurs, and missing out on huge opportunities, points out Morgan Stanley. Its report findings reveal that 45% of VCs don’t know how the returns from companies with female founders compare to their overall portfolio returns, and 53% were unsure about returns from companies founded by those with a ‘multicultural’ background.

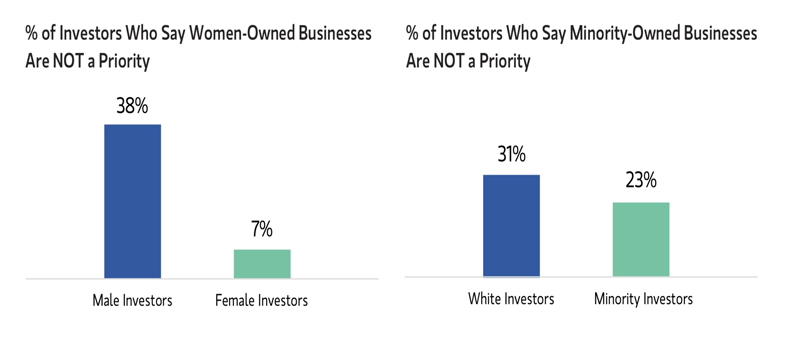

Outdated methods of finding companies are also holding back some VCs who actually are prioritising diverse entrepreneurs, the findings reveal. These investors continue to rely on traditional, but unsuccessful approaches, such as connections within their networks or ‘warm’ introductions to find diverse entrepreneurs. This may explain why more than half (53%) of male-dominated VCs also believe there aren’t enough female founders out there, and why 43% think the same about multicultural entrepreneurs.

These percentages stand in stark contrast to the VCs led by women and non-white males, who are more likely to prioritise investments in diverse founders, compared to their white male counterparts.

GENERATING SUPERIOR RETURNS

“Our research indicates that with a few subtle shifts in their approach, VCs can better position themselves to take advantage of these entrepreneurs and generate superior returns,” stated Carla Harris, Vice Chairman, Global Wealth Management and Multicultural Client Strategy Group Head at Morgan Stanley . “I hope that this report will help to inspire more firms to re-evaluate their investment strategies so they can capitalise on these opportunities that have historically passed them by.”

The report also provides VCs with guidelines on how to invest in more women- and multicultural-led firms. Morgan Stanley advises VCs, to firstly redefine how they think about ‘fit’ and ‘expansion risk’ for their portfolio, by including more companies founded and led by diverse entrepreneurs.

SHARING D&I DATA

Secondly, it suggests that VCs improve their internal D&I programmes to hire and retain more diversity. After all, the more diverse perspectives a VC has, the better it will get at recognising opportunities and identifying pitfalls. The report reveals that VCs that hire more diverse fund managers, partners or board members, reported it to be a ‘very effective’ way to increase the diversity of companies/founders they invest in.

Finally, to demonstrate a commitment to D&I to potential investors, it’s important for VCs to share both internal and portfolio diversity data, as well as establish goals for investing in more female- and multicultural-led businesses, advises Morgan Stanley.

For a copy of the Beyond The VC Funding Gap report, click here.