A new report from the Centre for Ageing Better has highlighted shocking levels of inequality and discrimination suffered by staff aged over 50, especially those from Black, Asian and Minority Ethnic backgrounds.

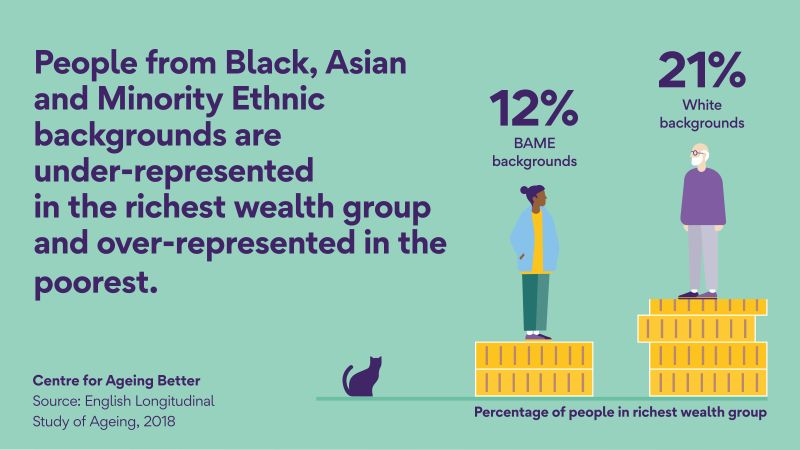

The report entitled ‘Boom and bust?‘ highlights how people from Minority Ethnic groups are much less likely to be in the richest wealth group; and much more likely to be in the poorest. Meanwhile, 17% of people from minority groups in their 50s and 60s are unable to meet their current financial needs, compared to 5% of people from White backgrounds. The research also found that a staggering 40% of people from minority ethnic backgrounds report low levels of satisfaction with their lives, compared to 26% of those from White backgrounds.

The research also raises concerns about the quality of work and degree of financial security those in their 50s and 60s are experiencing. Today, more than half of people in this group say their work is excessively demanding; almost doubling since 2002. One in three say they feel a lack of control over their work, compared to just 9% in 2002. At the same time, there is a risk that poor health could push many out of work early, with a third of this group saying their health impacts their ability to work; meanwhile, 42% of workers in this age group also have caring responsibilities.

WORSENING INEQUALITY

Without urgent action, inequality is only going to get worse, according to the experts. “It’s clear from these findings that older people from Black, Asian and minority ethnic groups are suffering the most when it comes to really fundamental aspects of their lives,” highlighted Jabeer Butt OBE, CEO of the Race Equality Foundation. “Financial disadvantage is just one example and is particularly acute for Black communities, with the sample analysis showing that Black people earn £397 a week compared to White and Asian people’s £500 a week. If we want to stop inequality from becoming further entrenched, and build a future that is fairer for everyone, the Government needs to face reality and develop long-term policies on housing, ageing and poverty through a clear race equality lens.”

Policy makers have failed to consider the impact of big societal changes, such as longer working lives, on this group, so it’s calling for government to show greater leadership on ageing. “We are sleepwalking into a crisis of later life: 2.6 million people in their 50s and 60s are on course for an old age marred by financial insecurity, ill-health and loneliness. Without action, not only will this group suffer, but future generations are likely to experience yet greater hardships in later life,” stated Carole Easton, Chief Executive at the Centre for Ageing Better. “Our new research lays out, for the first time, who makes up this forgotten generation. They are more diverse than ever before – but also more unequal. Their experiences of work are worse than that of the previous generation, and they are less connected to the people around them.”

FORGOTTEN GENERATION

Easton said she hopes this report is “a spur to action for policy-makers”. :For too long, this group have been overlooked in favour of stereotypes about wealthy baby boomers. But our research makes it clear that doing nothing is not an option,” added Easton. “We need to see government showing real leadership and adopting a clear strategy on ageing, to ensure no-one misses out on a good later life.”

According to the report, people in their 50s and 60s today are not only at risk of becoming a ‘forgotten generation,’, but they are facing greater challenges than those who were the same age in 2002. The report found that one in five people in this age group – some 2.6 million people – will most likely experience an old age marred by multiple, long-term problems such as poor health and poor finances, and will be at risk of loneliness and isolation. Poverty is already on the rise amongst this group, with those in their 50s and 60s seeing a greater rise in poverty than younger age groups since 2010.

The research, which analysed national data from almost 14,000 50-70-year-olds, found that financial inequality in this cohort has increased dramatically since the turn of the millennium. The richest people in their 50s and 60s today are twice as wealthy as the richest in this age group were 16 years before, while the poorest are almost a third poorer. One in five say they will be unable to meet their future financial needs in old age – with a decline in home ownership meaning that many will be unable to rely on housing assets in later life. Gender inequality is also significant: by any measure of wealth, women are approximately 10% worse off than men.

IMMEDIATE ACTION VITAL

In spite of the risks facing this generation, little policy focus has been dedicated to alleviating these challenges. But, without action, many will suffer poverty, ill-health and loneliness in old age – with a real risk that the experience of later life will worsen further for future generations. “Our research shows that unless we take immediate action to improve the prospects of men and women who are in their 50s and 60s now, a large proportion of these people are on track to do worse and experience even greater inequalities in their health, financial circumstances and wellbeing, when transiting into later life,” added Paola Zaninotto, Associate Professor at UCL Institute of Epidemiology & Health.

“Cumulative disadvantage is already apparent with people from Black, Asian and other minority ethnic groups being at greater risk. The number of older minority ethnic groups will inevitably increase over time, there is therefore the need to change their trajectory through appropriate support, services and interventions, to make sure that everyone is able to make the most of our longer lives.”

INVESTING IN OLDER WORKERS

We need to move on from stereotypes of affluent, home owning baby boomers, according to Clare McNeil, Associate Director at IPPR. “More of those in their 50s and 60s today are living in the private rented sector, affecting their ability to save for retirement. This is particularly true of those from Black, Asian and minority ethnic backgrounds, who are much less likely to own their own home outright and more likely to experience financial insecurity,” commented McNeil. “Just as important for health and security in later life however are good relationships, and with more people in their 50s and 60s saying they are missing out on these than in the previous generation, efforts to tackle loneliness and social isolation should increasingly include these age groups.”

Click here to download the report. The International Longevity Centre UK has highlighted the economic opportunities of investing in older workers and ageing strategies across Europe. Click here to read more.