Lloyds Banking Group has admitted that it needs to do more to fix pay inequality, as it became one of the first major UK high street lenders to disclose its ethnicity pay gaps.

Figures released in its fist ethnicity pay gap report on Friday, revealed that Black staff are being paid around a fifth less than their colleagues. The report, which forms part of its Race Action Plan, found that the median pay gap between Black staff and their colleagues was 19.7%; the bonus gap stands even higher at 37.6%. The bank attributes the earnings gap due to a lack of Black staff in senior positions.

Commenting on the pay gap, Lloyds Banking Group Chief Executive António Horta-Osório, stated: “Our Black colleagues remain significantly underrepresented at all levels, accounting for just 1.5% of our total workforce and 0.6% of our senior management. That’s not good enough; and it’s why we have resolved to take action. We want to be clear that we are an anti-racist organisation; one where all employees speak up, challenge, and act to take an active stance against racism. In doing so, our colleagues will help break down the barriers preventing people from meeting their full potential.”

ETHNICITY PAY GAP BREAKDOWN

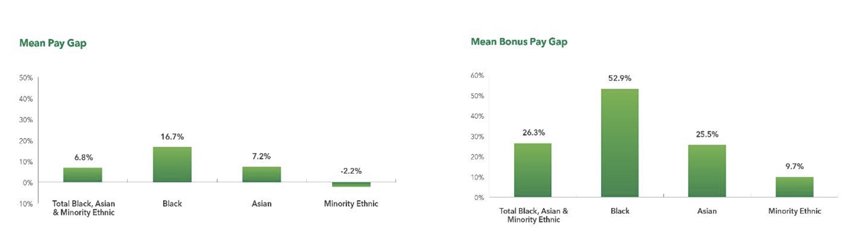

Breaking down the data further by ethnic group, “the pay difference is widest for our Black colleagues with a far lower representation at senior grades, creating an overall difference with a mean average pay difference of 16.7% and a median average pay difference of 19.7%,” Horta-Osório explained.

For Asian colleagues the mean average pay difference is 7.2% and a median pay difference of 15.7%. For Minority Ethnic colleagues the mean average pay difference is -2.2% with an average median pay difference of -0.5%. “Our target is to increase Black representation in senior roles to at least 3% by 2025. It’s by achieving this goal that will enable us to close the pay difference and create a truly diverse workforce,” he added.

LONG WAY TO GO

In response to the Black Lives Matter protests this summer, the bank pledged to increase the number of Black staff in senior roles to 3% by 2024. Although the bank has made some good progress since then, including publishing its Ethnicity Pay Gap report, there is much more to do, admitted Fiona Cannon, Lloyds Banking Group’s Sustainable Business Director.

“The UK’s Black community has been underrepresented in boardrooms and within the broader business landscape for far too long. It’s time for change,” noted cannon. “We know we still have a long way to go. As one of the UK’s largest organisations we have a responsibility to do all that we can to ensure the business community is representative of the country we’re proud to be a part of.”

To better understand the needs of Black business owners and aspiring business owners, Lloyds also announced plans to launch a Black Business Advisory Committee, led by Claudine Reid MBE. “The Black Business Advisory Committee will provide us with honest, direct feedback and direction on the steps we can take to address the challenges faced by the Black business community. With these insights, and working together with our partners, we stand ready to support Black-owned businesses,” explained Cannon.

Commenting on the new role, Reid stated: “I’ve taken on this role to help the UK’s largest financial services group on its journey of change and transformation. It’s become clear to me that Lloyds Banking Group is not simply paying lip service to issues relating to Race, but is ready and willing to learn, develop and lead in improving Black representation in business.”

OVERCOMING BARRIERS

“Disappointingly, the number of Black FTSE 100 CEOs, CFOs or Chairs has fallen to 0.7% and, as a recent report by the British Business Bank has shown, Black business owners also face challenges when it comes to starting up and growing their business,” added Reid. “The proportion of Black business leaders in the City and the barriers faced by Black business owners across the country undermines the important role the Black community plays in the UK’s ongoing social and economic life.”

The committee will investigate the barriers to growth for the Black business community, via rigorous research of the whole business life cycle. It plans to share research findings and recommendations in Q1 2021, confirmed the bank. “The report will also underpin future actions to ensure Black-led businesses have the best opportunity to start, grow, adapt and thrive.”