The latest research from the Buy-side Trading Community (BTC), operated by K&K Global Consulting, has reiterated the need to reduce Europe’s trading hours to improve employee diversity and wellbeing.

The survey follows the Association for Financial Markets in Europe (AFME) and the Investment Association’s (IA) recent request for shorter exchange trading hours in Europe, as recently reported. BTC’s research reveals that the majority of its traders support the need to reduce exchange market hours, from 8.30/9am until 4pm UK time (9.30/10am until 5 pm CET), to improve wellbeing and diversity in the sector.

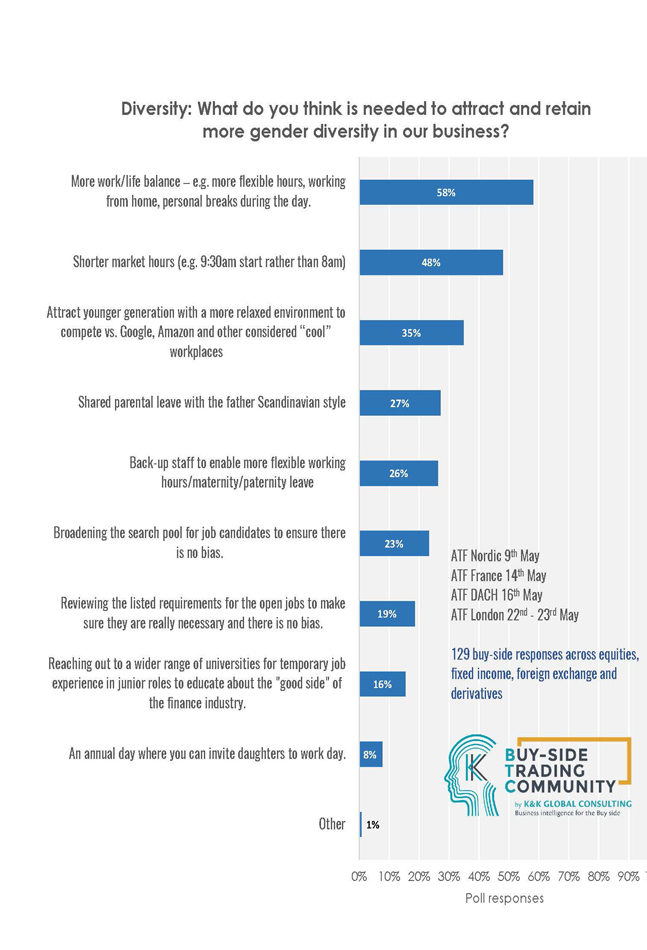

Approximately 58% said ‘more flexible hours/flexible work arrangements to support work/life balance was vital to attract more gender diversity’, followed by fewer hours (ie 9.30 start rather than 8am) for just under half the respondents. Others cited that a more ‘relaxed’ work environment ‘Google or Amazon-style’ would help to attract younger generations (35%). Shared parental leave would also help improve gender diversity in the trading industry, according to 27% respondents.

The survey polls were conducted over the course of 2019 at the BTC’s private, exclusive and invitation only Alpha Trader Forum meetings held in London, Paris, Frankfurt and Stockholm.

CREATING ‘ATTRACTIVE’ WORK ENVIRONMENTS

“We identified that only 10% of our buy-side trading contacts were women, so we launched an awareness campaign to research and study how the buy-side trading desk could become a more attractive and inclusive working environment,” said Anita Karppi, Managing Director and Founder of the BTC. Its research unveiled that buy-side trading is not a job ‘where people are earning elaborate amounts of money when factoring in the pressure to perform during long working days’, compared to other ‘white collar’ industries.

“It is important to note that the buy-side trader is generally expected to spend additional hours, over and above the exchange open hours, to finish off administrative work and prepare for the next exchange opening,” confirmed Karppi. “The direct correlation between exchange trading hours and the necessary work-life balance, to both attract new and retain experienced talent, is obvious.”

However, discussing the impact of the long hours work culture “on each individual’s mental and physical well-being is somewhat more taboo”, she pointed out. Nevetheless, BTC received an “overwhelmingly positive reaction to the D&I initiative as many senior representatives have vouched for the impact of diversity of thought on trading performance, which ultimately is in the best interest of the end investor,” added Karppi.