Despite growing calls for gender diversity, the number of women CEOs in the S&P 500 dropped by nearly 20%, while CEO firings reached a historic high, revealed a new report.

At the end of 2018, women held 22 CEO positions in the S&P 500, down from a record 27 in 2017, according to a new report published by The Conference Board in partnership with Heidrick & Struggles. Only one additional woman joined the CEO ranks last year – Kathy Warden of Northrop Grumman, the report reveals.

“While the number of women CEOs has increased significantly since the report began – reaching their highest levels in 2017 – the trend has suddenly reversed with the number of women CEOs dropping to pre-2016 levels,” pointed out Bonnie Gwin, Vice Chairman and Co-Managing Partner of the CEO & Board Practice, at executive search firm Heidrick & Struggles. “As companies increasingly look inward for their next CEO, companies must do more earlier to develop and train high-potential women leaders and add them to their CEO-ready lists.”

CEO OUSTINGS RISE

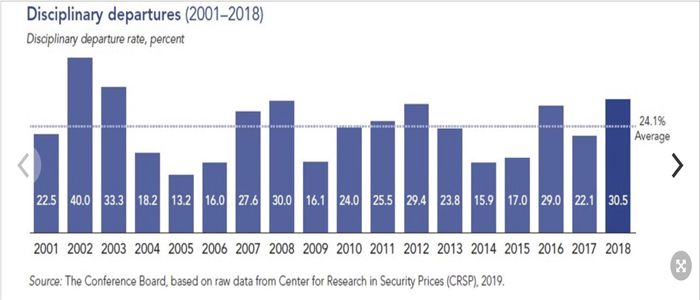

The study, which examined CEO succession in 2018 by comparing historical data that the Conference Board has been collecting since 2001, also reveals that CEO firings have reached a historic high. Non-voluntary CEO departures climbed to 30.5%, up almost eight percentage points from 2017. Five CEOs from the S&P 500 were ousted in 2018 due to #MeToo-related misconduct, representing more than 40% of all CEO dismissals, compared to just one CEO departure for personal misconduct in the S&P 500, between 2013 and 2017.

“With the rise in CEO departures and as the CEO role continues to evolve, we’ve continued to see the need for boards to proactively plan for a range of scenarios and to make succession planning a high priority,” said Jeff Sanders, Vice Chairman and Co-Managing Partner of the CEO & Board Practice of Heidrick & Struggles.

CEO TURNOVER

The survey findings revealed that company insiders claimed almost all vacant CEO positions (90%) in 2018, accounting for 52 out of 59 openings. Of the 52 insiders who became CEOs, 20 of them had at least two decades of experience at the company. This reflects the value that boards place on continuity and in-depth organisational knowledge when selecting a leader, according to the report authors.

The report also found that departing CEOs had stayed in their roles for an average of 10 years. After hitting a low of nearly seven years following the ‘great recession’ years, CEO tenure has increased almost every year over the past decade, reaching the 10-year mark in three of the past four years.

“The rate of succession among older chief executives continues to climb, and there are still more CEOs aged 75 and over than there are CEOs under the age of 45,” explained Matteo Tonello, Managing Director of ESG Research at The Conference Board’s ESG Center, and the principal author of the report. “In the coming months and years, a softening economic environment may very well unfold. Boards should be prepared, given a slowdown would likely spur an acceleration of CEO retirements and tightening of the market for top talent.”

Adding to his comments, Jason Schloetzer, Associate Professor of Business Administration at Georgetown University’s McDonough School of Business, and co-author of the report, said: “A buoyant market environment and quality leadership development programmes are likely key contributing factors to the lengthening of CEO tenure and the overwhelming elevation of insiders to the CEO position.”

CEOs in the retail and wholesale sector experienced a lower succession rate of just 7%, compared to 12% across the whole S&P 500. Generally CEOs in this sector suffer the ‘highest’ CEO turnover rates, but these findings suggest that the reported ‘retail apocalypse’ may have run its course, or, at the very least, slowed down substantially. This time, the transportation industry and consumer product sectors had the highest CEO dismissal rates, with non-voluntary departures accounting for 40% and 33.3% of dismissals, respectively.