The CIPD has called on all employers to recognise both the moral and business case for taking more responsibility for their employees’ financial wellbeing.

Despite the financial hardship caused by Covid-19, half of employers (49%) don’t have a financial wellbeing policy, revealed CIPD’s latest Reward Management Survey. According to the professional body for HR and people development, a financial wellbeing policy is “a must” as it acknowledges that, as income providers, organisations play a vital role in their workers’ financial wellbeing. It can be as simple as a commitment to signposting to independent money and debt guidance, offering access to low-interest loans and running pension workshops.

FAIR PAY & BENEFITS

According to the study some employers have already taken steps to help employees struggling financially. In fact, 12% of employers have already introduced, or plan to introduce, a financial wellbeing policy in direct response to the pandemic. And approximately 19% are planning or considering becoming an accredited Living Wage Foundation employer.

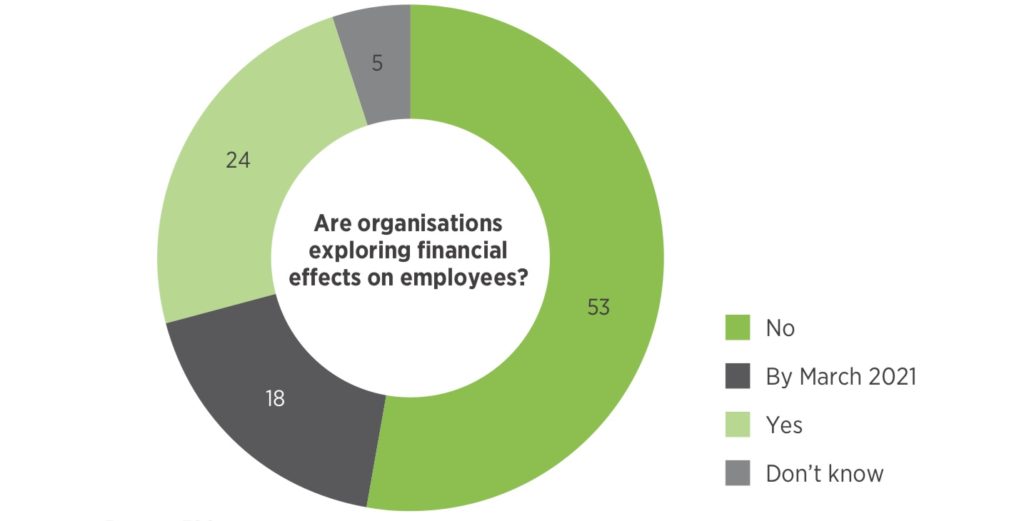

Around a quarter of employers have explored how the pandemic has impacted their employees’ financial wellbeing, so they’re better able to identify the right kind of support. Another 18% plan to do so by the end of March 2021. Interestingly, nearly a third (30%) of employers say the pandemic and the economic crisis has prompted them to consider how fair their pay and benefits are. Another quarter (25%) are taking corrective action or plan to do so.

PANDEMIC IMPACT ON FINANCES

While the CIPD welcomes these positive moves, it said it wants every large employer to have a financial wellbeing policy, which feeds into their wider wellbeing strategy and, ideally, put a budget behind it. “The pandemic has, unfortunately, hit many people’s finances hard, with many losing their jobs and others seeing their income fall. This has no doubt focused many employers’ minds on fairness and in-work poverty. And it’s good to see a number of them taking steps to protect people’s financial wellbeing during the pandemic,” commented Charles Cotton, Senior Performance and Reward Adviser at the CIPD.

However, Cotton believes that there’s an opportunity to do more. “We’ve seen many employers really step up to the plate when it comes to supporting their employees’ mental wellbeing during this crisis; and we’d like to see the same attention given to their employees’ financial wellbeing. For too long it’s been considered the poor relation to wellbeing, but we know the two are intrinsically linked and should have parity.”

The CIPD is encouraging employers to act quickly since low-income workers have suffered the sharpest drop in earnings during the pandemic. According to the Financial Conduct Authority, a quarter of the UK adult population now have low financial resilience.

FINANCIAL WELLBEING POLICY BENEFITS

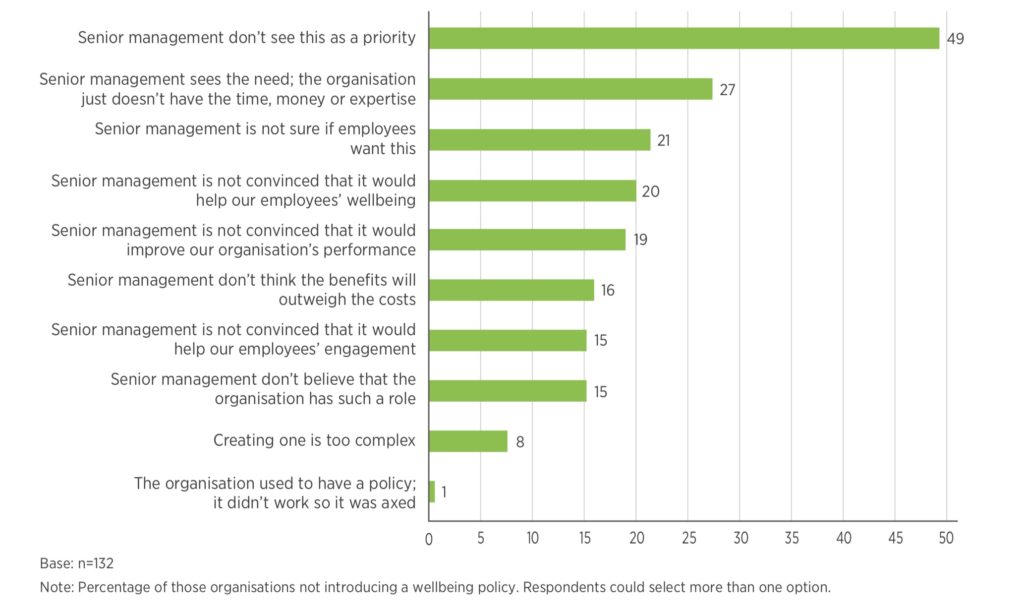

As well as affecting an individual’s health and wellbeing, money and debt worries can impact people’s performance at work, which can have knock-on implications for their employer’s productivity and bottom line. However, the report suggests some employers don’t recognise the strong business case for having a financial wellbeing policy. The most common reason given by employers for not having one was that senior management don’t see it as a priority right now (49%). Other reasons include:

- 27% said that senior management see the need for a financial wellbeing policy, but don’t have the time, money or expertise to create it.

- 21% said they weren’t sure employees would want such a policy. Tthis decreases to 11% for those who’ve asked their employees what impact the pandemic has had on their financial wellbeing.

- 20% aren’t sure it would contribute to employees’ wellbeing.

- 19% don’t trust a policy would improve their organisation’s performance.

PRIORITISING FINANCIAL WELLBEING

The retail, hospitality, catering, leisure and cleaning sectors were most likely to report that their senior management don’t see a financial wellbeing policy as a priority (64%). However, employers in these sectors were also most likely to say they thought their employees’ finances had been adversely affected by the pandemic. Other findings from the report, reveal that:

- A quarter of employers (25%) will have revised how much they have spent on employee pay (both fixed and variable) by March 2021. Of these, 50% will reduce pay and 25% will increase it.

- Only 7% of organisations are changing pay to reflect home working or have plans to do so. A quarter don’t intend to do so, while 16% are keeping the issue under review.

- A quarter (26%) of organisations intend to change the amount spent on employee benefits this year. Of these, 44% are increasing spend and 40% are decreasing spend.

- A fifth of organisations (19%) are making changes to their reward practices in response to last summer’s Black Lives Matter protests. Those taking action are mainly public and voluntary sector organisations.

CIPD RECOMMENDATIONS

“Whilst we fully acknowledge how tough it is for businesses right now, with many just focusing on surviving, we think there’s a strong case for employers to be doing more to support their people’s financial wellbeing. It may well be that even light-touch steps, such as signposting to independent money and debt advice, can start to make a difference,” pointed out Cotton. “It should also be said that every employee stands to benefit from having better access to financial wellbeing support, particularly at key life stages, such as when they are starting out, becoming a parent or retiring.”

According to the CIPD, a financial wellbeing policy should include the following:

- Signposting to financial wellbeing advice, such as the resources available from the Money and Pensions Service (which small employers can do easily).

- Targeted financial education support at key moments in working lives. For example, ahead of maternity leave.

- Revising benefits packages to include finance-friendly initiatives, where employees are able to choose how often they’re paid.

- Implementing flexible working policies so employees with caring responsibilities can balance working enough hours to comfortably pay their bills.

- Giving people security over their hours and helping them to progress into higher-paid roles.

- Committing, where possible, to paying all employees at least the Real Living Wage.

Click here to download CIPD’s Reward Management Survey.